Digital Banking FAQs & Logging In

Managing your financesーwherever you areーis a cinch with Digital Banking. FAQs on registering, logging in, tools, and services are outlined below.

What features does Digital Banking offer?

- Integrated Bill Pay: A fully functional experience on desktop and mobile.

- Advanced Security: Active defenses and strong encryption keep members and data safe.

- Mobile Deposit: Easily deposit checks on the go with a point and click.

- Card Controls: Instantly lock and unlock your credit and debit cards from anywhere.

- Instant Notifications: Stay informed of any changes or transactions in your accounts.

- Dashboards: Engaging, personal design that provides access to everyday tasks.

- Savings Goals: Set savings goals and keep track from your home screen.

- Spending Trends: Take control of your finances by viewing where your money is being spent.

I’m new to Digital Banking. How do I start?

Registering for Digital Banking is your first step. You’ll need your member number and other personally identifiable information to register. Just click the [MSCU Digital Banking Registration Form] and follow these prompts:

- Provide your account information (do NOT enter the leading 0s).

- Receive an access code on the cell phone or email we have on file for you.

- Enter the access code (each code is valid for 10 minutes).

- Create a username and password.

- Agree to the Terms & Conditions.

- Start exploring Digital Banking!

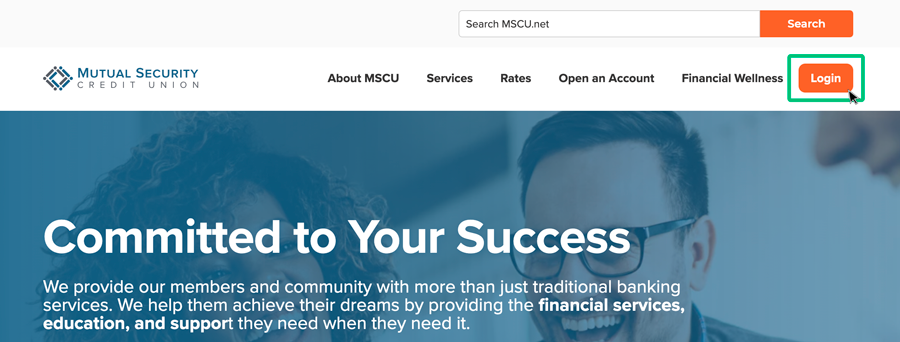

You can also register by hovering over the orange Log In button at the top right of all MSCU.net webpages and clicking on Register Now. Follow the same steps outlined above.

If you need assistance, please don't hesitate to call us at 1-800-761-2400.

I’ve used Digital Banking before. How do I log In?

Once you’ve registered for Digital Banking, you can log in any time from anywhere. To log in, follow these prompts:

Hover over the orange Log In button at the top right of all MSCU.net webpages.

What browser can I use to register or log in?

For an optimal and secure user experience, please use a recent version of one of the following supported web browsers: Google Chrome, Firefox, Safari (macOS only), or Edge (Windows only). Internet Explorer is NOT supported.

Learn more about keeping your web browsers and mobile operating systems up-to-date.

Are my account and personal information secure when I log in?

Your privacy and security is important to us. All financial information in MSCU’s Digital Banking platform is encrypted when you provide it and when we store it.

Can I customize my Digital Banking dashboard?

Yes. Your first screen after logging into Digital Banking will be your dashboard. Also, the “View My Accounts” tab defaults to your dashboard. To customize your dashboard, select the “Customize” toggle. This will enable you to adjust selected widgets to align with your preferences.

Can I make transfers?

Yes. You can easily set up transfers to and from your MSCU accounts for single and recurring transfers.

How do I set up external transfers?

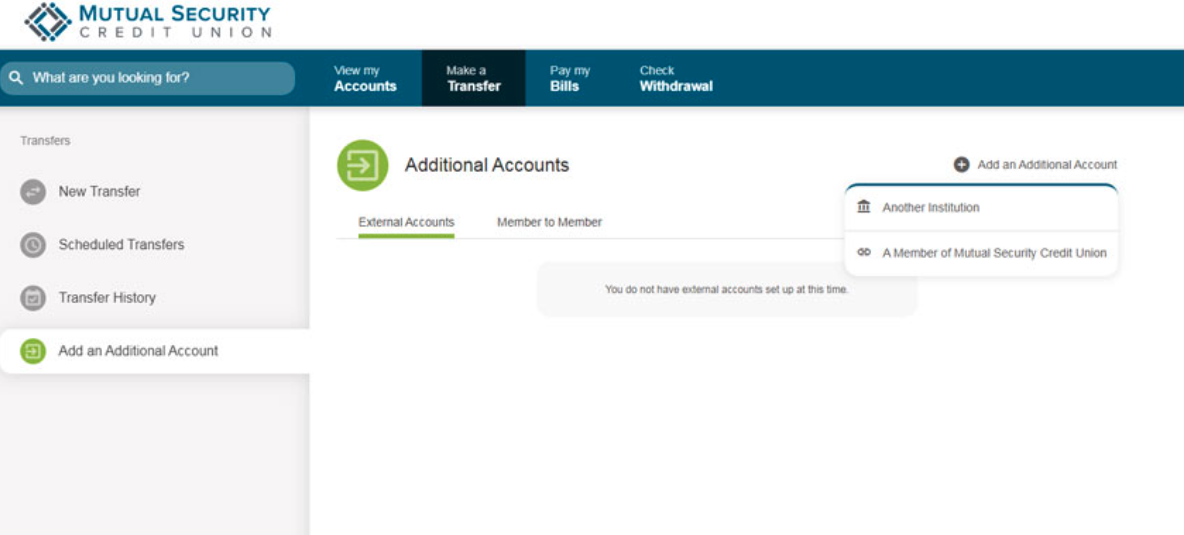

To transfer funds to an external account一an account at another financial institution一or another MSCU member, the account information must be added [to your dashboard/menu items] first. Start by following these steps:

- Select Make a Transfer from the top menu.

- Select ⊕ Add an Additional Account from the top right.

To add Another Institution:

- Select Another Institution from the dropdown menu.

- Click the icon for the desired institution or type the name in the Search for a financial institution field. If you can’t find the financial institution on the Default List, scroll down and click I can’t locate my financial institution.

- Enter the Routing Number. If your financial institution was not on the Default List, enter an Account Nickname.

- Enter, then re-enter the Account Number.

- Select the Account Type (Checking, Savings, or Loan).

- Click the Connect button.

To add an MSCU member:

- Select A Member of Mutual Security from the dropdown menu.

- Enter the member’s First Name and Last Name.

- Enter an Account Nickname.

- Enter the Account Number.

- Enter the Account Type.

- Click the Next button.

Does Digital Banking have account notifications?

Yes. You can keep up to date with your finances and accounts by turning on alerts, including alerts for:

- Account balances

- Check clearance

- Logins

- Transactions and transfers

- Card location, spending, and transactions

- Security

I use Quicken/Quickbooks. Do I need to change my settings?

Yes. If you use an Intuit product to manage your finances, download the instructions below for your version of Quicken/Intuit software:

Windows Users:

Mac Users:

Online Users:

Can I use bill pay on the Digital Banking platform?

Yes, but please note:

- On the day you schedule a payment to be sent to your merchant, funds needed to complete the payment will be held while the payment is being processed.

If insufficient funds are available on the scheduling day, MSCU will try once on each of the next two business days for a total of three attempts (including on the scheduling day). If funds are still unavailable to make the merchant payment, the transaction will be canceled. - For merchants who can’t receive an electronic payment, a paper check will be issued, and the funds debited from your account on the same day.

How do I set up MSCU’s mobile app?

Install the MSCU Mobile app by clicking the appropriate links below or searching 'MSCU Mobile' in the Apple App or Google Play Store.

I have more questions about Digital Banking. Where can I find answers?

If you can't find the answer to your questions here, visit the FAQ search in the Digital Banking platform. From answering how to set up account alerts to learning how to dispute transactions, these FAQs will come in handy!

Still have more questions or need help? No problem!

Please don't hesitate to contact us. We’re here to help! Call a member of our customer service team at 1-800-761-2400, option 3 or Use the form below to submit your questions or comments, and a team member will be in touch.

To protect your online safety, security, and privacy, do not include your account number, credit card number, and/or social security number when using this form.